It's different from every course out there to date. Here's how:

The Proven Process

I've turned the unknown, gray area of how to start a multi-unit portfolio and turned it into a science. While others use guesswork, we use a predictable, proven process. We're certain it's going to make you wealthy. It's not even up to chance. The only thing that's up to chance is whether you'll do it or not. We've got a proven process.

A New Paradigm

I engineered a new way to think and reprogram your mind that is so profound, it's like seeing for the first time so you can become that new person I talked about in the webinar. People often tell me, "I see the world differently. Things are different now. My life has changed - for the better."

I'm not joking around here or talking hocus pocus stuff. When you reprogram your mind and install this new paradigm, you're going to see things differently. You're going to think and behave differently, and you're going to become a different, person - a better version of yourself.

If you've ever wondered what makes a billionaire a billionaire, it's that they think different. They see the world different. What you might see as a problem, they see as an opportunity. What you see as a disaster, they see as something else. You don't see the same things they see, and you definitely don't have the same thoughts they have.

People who are really successful have profoundly different paradigms and worldviews than the ones society has adopted and installed into us by default. There really hasn't been a time before where someone has given everyone a corrected paradigm to operate with, but that's what I've done with this program.

We're able to get this new, better way of viewing the world installed in most people in just a few weeks. It took me my entire life to figure out how to do this, and it takes billionaires their entire lives, too. But we literally get you thinking differently in just a few weeks.

A Winning Community

It's hard to change your life when you're surrounded by the same people you've always been surrounded by. But we have a solution to this problem. All of our students join a worldwide community of people on the same path, so their dreams aren't laughed at, but achieved on a daily basis. We all have abundant mindset and don't mind sharing our knowledge, contacts, best practices, and more to help you become successful.

With this program, you will have access to the Facebook group, and you will want to start hanging out in the Facebook group. You can still be friends with the people you're friends with, and you can, of course, keep the same family. I'm not saying you have to leave them or anything. You just need to find a healthy balance between people who believe they can win, and your family and friends.

Because if you just have your family and friends, they're going to pull on your belief in yourself, and you're going to end up back down at their level. You need to have a healthy balance, so always remember that.

Expert Mentorship

Most of the time, it's not a good idea to talk about your dreams and investing ideas in front of people who aren't investing themselves. It will just draw criticism. But how can they judge your dreams and ideas? They're not even in business for themselves.

So, it's probably a good idea to ask business questions and talk about your dreams with people in our community, and when it comes to hanging out with family and friends, keep those things separate. This way you can keep your mind in the right place and in expert mentorship.

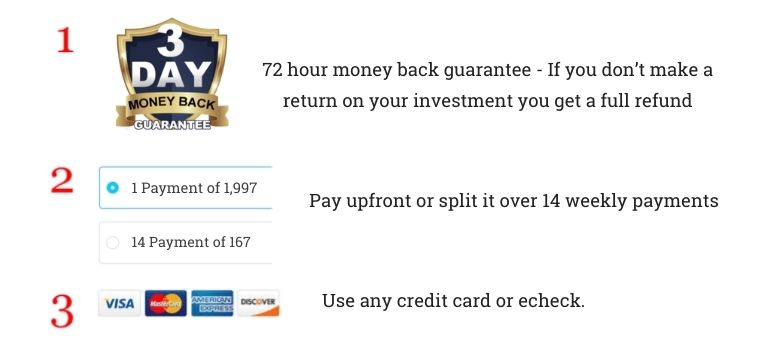

Everyone needs advice and help when tackling new challenges, but true experts are out of reach for most people. You know experts cost a lot of money. I don't even sell my time anymore.

People routinely offer me five, six grand for an hour, and I say no every time. If you don't believe me, you can try it. You can email and offer me for 6k an hour, and you're going to get rejected. I'm not even making that up.

People who give really good advice are expensive, and most of the time they are out of reach. However, I've figured out a way to get expert mentors in touch with ordinary, everyday people in a way that is economical.

That is through our Facebook community and our group calls. I jump in the Facebook group often, and I've got millionaire experts and coaches who also jump in and help there, too. This is how we can provide expert mentorship to everyone.

These four elements make up what I call the perfectly engineered change agent. As you're going through this process, it's important to remember these four things.

Always remember that just one of these things on its own isn't going to get you where you want to go. You need it all. All four parts are equally important, and if you take one out, the whole thing will fall over. You must keep all four at all times.